What to Look For in the Next Disruptor of Payments: 3 Innovations to Watch

Aug 30, 2016 / By Vanessa Horwell

When PayPal emerged from Palo Alto in 1998, few knew how impactful the small technology company ultimately would become. PayPal not only disrupted the payments industry at large, its technology and innovation-driven founders shaped the future of the next 18 years of the digital payments sector (and many other industries, too).

But in 2016, PayPal – one of the original disruptors of Silicon Valley – is no longer an upstart. It is now a member of the old guard. The payments space is, to use PayPal VP Ben Edwards’ own words, in a “boiling ocean of disruption.” Payments are changing consumer and business expectations. The game is heating up fast, thanks to the rise of smartphones and the emergence of alternative digital currencies.

Who Will Emerge as the PayPal of the Future?

So which of the “new new” disruptors will become the industry’s big winners? It's tough to say. Given today's far more rapid pace of change compared to 1998, there will never be another PayPal. CB Insights has identified 109 startups looking to disrupt the industry, and that number will only grow in coming years.

And PayPal itself is in on the startup-spurred shifts in fintech. It is using smart acquisitions to keep itself relevant to the future of payments. In 2013, the company acquired Braintree, which owns Venmo – the popular mobile app that allows peer-to-peer money transfers via smartphone. In January, PayPal added Wences Casares, one of the entrepreneurs behind Bitcoin, to its board of directors. The move was seen by many as a signal of the company’s growing interest in next-generation transaction models and "cryptocurrencies."

Eventually though, there will be another upstart that shakes up the payments game more significantly than anyone we’ve seen of late. The question now: What will that disruptor bring to the table? Three areas emerge as likely possibilities for disruption.

Cross-Border Payments: A reported 70 percent of global consumers have bought from merchants in other countries, and online cross-border shoppers spend twice as much as their domestic counterparts. But the infrastructures supporting cross-border payments remain inefficient – lacking the speed and transparency afforded to domestic transactions. Fintech companies have a huge opportunity to shape this area.

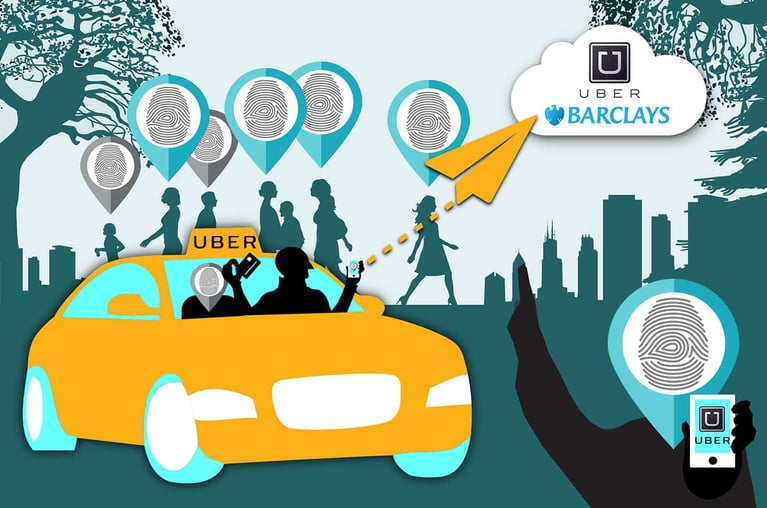

Connected Card Payments: Are all-in-one, "connected credit cards" a missing link in the payments value chain? (A 2014 survey found that more than 75 percent of consumers are interested in them). Multiple startup players are experimenting with mobile or other wireless cards designed to replace the ubiquitous plastic(s) in our wallets.

Retail Banking Digitization: With services like Venmo proving more convenient and useful than similar services from traditional retail banks, consumers are increasingly poised to expect more from their retail banking partners. Startup players who service the transaction banking space may ultimately deliver (much-needed) disruption to the big guys through smarter digital infrastructures and services.

A recent survey of 4,000 European shoppers gives a hint of what's ahead. More than half (52%) expect to be paying via smartphones by 2021, and 51% think they will use mobile wallets and apps like Apple Pay and Android Pay to do so. Another 37% embrace the notion of biometrics to pay, and 17% are open to cryptocurrencies like Bitcoin.

What do you think the next "disruptor of payments" will bring to the table? We’d love to hear from you. You can also read more on our thoughts on the payments sector now.

Sign up for our insights on the convergence of business and PR